Ifrs 16 Example Journal Entries

In the May 2018 version of Accounting Alert we noticed that IFRS 16 Leases IFRS 16 which becomes effective for financial detailing periods starting on or after 1 January 2019 will in a general sense change the way. The company has just followed IFRS 16 on 1.

Infografia Comparativa Col Gaap Vs Ifrs Analisis Financiero Estados Financieros Estado De Resultados

A fter a nearly 10-year collaboration to develop a converged standard on leasing on Jan.

Ifrs 16 example journal entries. IFRS 16 summary. Letâs say itâs straight line over the lease term of 5. Inception date of lease.

IFRS 16 sets out a comprehensive model for the identification of lease arrangements. Utilizing the amortization table the journal entry for the end of the first period is as follows. Right of use asset 11635712.

Lease modification change in consideration only. It will replace IAS 17 Leases for reporting periods beginning on or after 1 January 2019. Depreciation of the ROU asset.

OK OK guys sorry for not responding. Below we present the entry recorded as of 112021 for our example. If you are adopting IFRS 16 from IAS 17 you have to state the balances as if IFRS 16 has always been adopted.

First assume a tenant signs a lease document with the following predicates. IFRS 16 Leases was issued by the IASB in January 2016. 4 Introduction Lease modifications.

The initial journal entry under IFRS 16 records the asset and liability on the balance sheet as of the lease commencement date. IFRS 16 Sublease Accounting. Debit ROU right of use asset.

Lessees customers dont need to make a distinction between operating and finance leases as they account for all leases using one right-of-use model. Had Company used LIFO reserve would have been 5000 at the beginning of the year and 7000 at the end of the year. It relates to previous periods too.

Subsequently ABC needs to take care about 2 things. Therefore the standard is now effective for all organizations following international accounting standards. 25 2016 FASB issued Accounting Standards Update ASU 2016-02 LeasesTopic 842The two standards differ on some points but each accomplishes the joint objective of recognizing that leases give rise to assets and liabilities that should appear on.

IFRS GAAP Example Matrix 1 Facts Discussion Journal Entry Dr Cr 1. Operating lease accounting example and journal entries. It means that you need to reverse all entries under IAS 17 and book entries under IFRS 16.

Numbers and journal entries IFRS 16 Leases contains detailed guidance on how to account for lease modifications. As a result on the commencement of the lease you will recognize the following journal entries. A lease modification is defined as a change in the scope of a lease or the consideration for a lease that was.

Under IFRS 16 the initial journal entry would be. Below is an excel example based on Example 19 from IFRS 16. Paragraphs IFRS 1663-65 provide examples and indicators that individually or in combination would normally lead to a lease being classified as a finance lease.

It can be applied before that date by entities that also apply IFRS 15 Revenue from Contracts with Customers. Key IFRS 16 Definition. The following is a full example of how to transition an operating lease from ASC 840 to the new standard ASC 842.

IFRS 16 sublease accounting entries is the same old thing for lessors yet makes intricacy in subleasing courses of action. In reference to calculation Example 1 from How to Calculate the Lease Liability and Right-of-Use Asset for an Operating Lease under ASC 842 the initial recognition values on 2020-01-01 are. Companies previously following the lease accounting guidance under IAS 17 likely transitioned to IFRS 16 during their 2019 fiscal year in accordance with the standards effective date of January 1 2019 for annual reporting periods beginning on or after that date.

In this video we go on to simplify the finance lease transaction in light of IFRS 16 from the lessors point of view with a clear example. Entity A enters into a 10-year lease for a 2000 sq meters of office space. You can access t.

The lease contract started on 1 January 2017 and the lease was recognized as operating lease since then. See also Example 16 accompanying IFRS 16 that illustrates the approach to modification that extends the contractual lease term. First adoption of IFRS 16 with an existing operating lease The company has rented an office with 5 years and the payment 120000 is at the end of each year.

US Parent Company uses LIFO method to account for its inventory. 13 2016 the IASB issued IFRS 16 Leases and on Feb. Details on the example lease agreement.

IFRS 16 introduces a single lessee accounting model and requires a lessee to recognize assets right-of-use and liabilities for All leases with a term of more than 12 months unless the underlying asset is of low value.

Financial Statement Example For Small Business

Exclusive New Research To Be Unveiled At Ragan S Workplace Wellness Conference Set For Next Wednesday Ragan S Workplace Wellness Workplace Wellness Employee Wellness Social Media

The Four Basic Financial Statements An Overview Statement Template Income Statement Financial Statement

Cash Flow Statement Cash Flow Spreadsheet Template

Audit Glossary All The Words And Phrases Defined Explained Audit Internal Audit Financial Information

Ifrs 16 Transition Series For Lessees Example 2 Amortization Schedule Finance Lease Transitional

Non Profit Financial Statement Template Elegant Non Profit Financial Statements Example Report S Statement Template Financial Plan Template Financial Statement

Icds Monthly Progress Report Fill Online Printable Within Monthly Progress Report Template Great Progress Report Template Progress Report Report Template

Solved Purchase Point Media Corporation Solutionzip Financial Information Critical Thinking Skills Accounting Principles

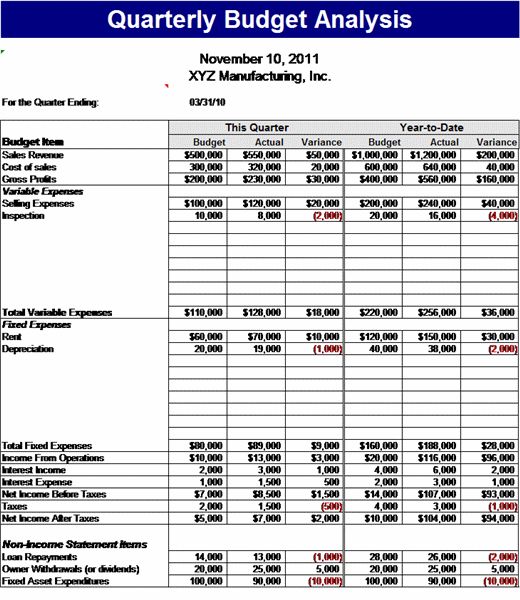

Quarterly Budget Analysis Template Word Templates Bundle Budget Sheet Template Budgeting Budget Sheets

Post a Comment for "Ifrs 16 Example Journal Entries"