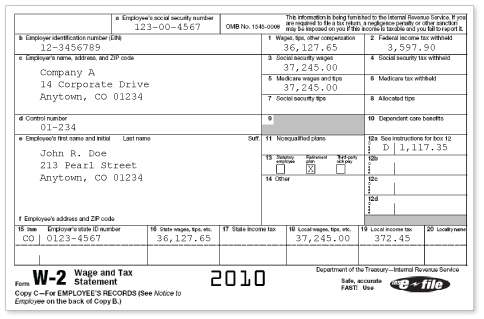

Example W2 With 401k Contributions

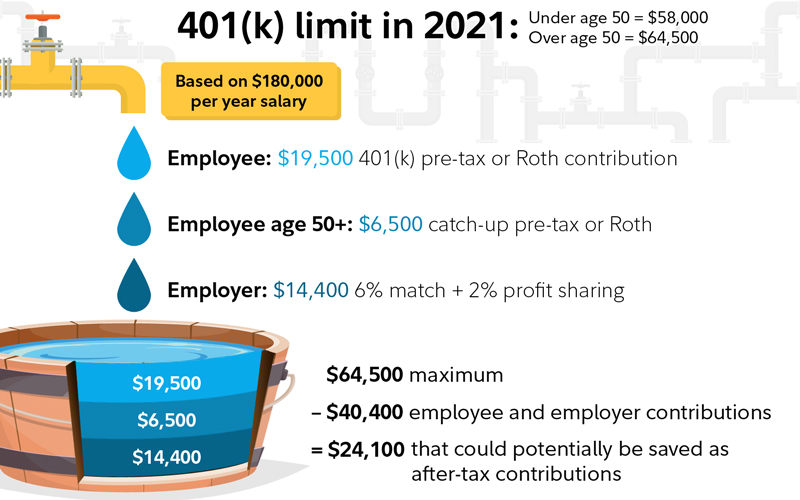

Many employers match employee contributions by adding for example 50 cents or 1 for every dollar the employee contributes. For employees in 2021 the total contributions to all 401k accounts held by the same employee regardless of current employment status is 58000 or 100 of compensation whichever is less.

Https Www Icmarc Org X3333 Html Rfid W1475

18000 - is the Employer contribution elective deferral.

:max_bytes(150000):strip_icc()/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Example w2 with 401k contributions. In 2020 and 2021 the maximum Robert can contribute to both plans at the individual level is 19500. CODE Y Box 12 Code Y reports the current year deferrals to a Section 409a non-qualified. In the Additions Deductions and Company Contributions section.

That is incorrect though. You can get to the W-2 section in TurboTax by searching for W-2 upper- or lower-case with or without the dash. 30000 - Elective deferral Solo 401K of which.

This amount can be expressed as a dollar amount a percentage of your salary or a percentage of your own contribution. Does my 401K contributions showing on my W2 qualify as a retirement contributions expense. Select the new payroll items for the retirement plans.

I have contributed through my S corp. For example say that you made 49000 at your job but put 4000 in your 401 k plan. 401k contribution limits only apply toward the employees contributions.

How to categorize solo 401k contributions as employee and employer. For example lets assume your salary is 35000 and your tax bracket is 25. Gross pay if paid twice per month 45000 per year.

For example an employees 2020 contribution limit is 19500. For example if you withhold a 401k contribution from employee wages on February 1 you would have until the 15th business day in March to deposit the contribution. That is the case whether it is going to a pretax 401k or a Roth 401k.

For example my total wages are 48000 on which I pay social security and Medicare. 401k Contribution Limits for 2020 vs. 35000 - 2100 32900.

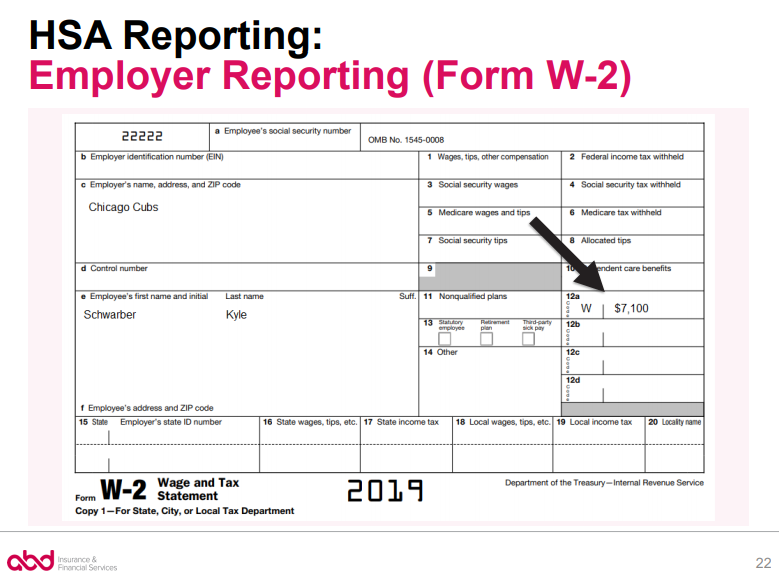

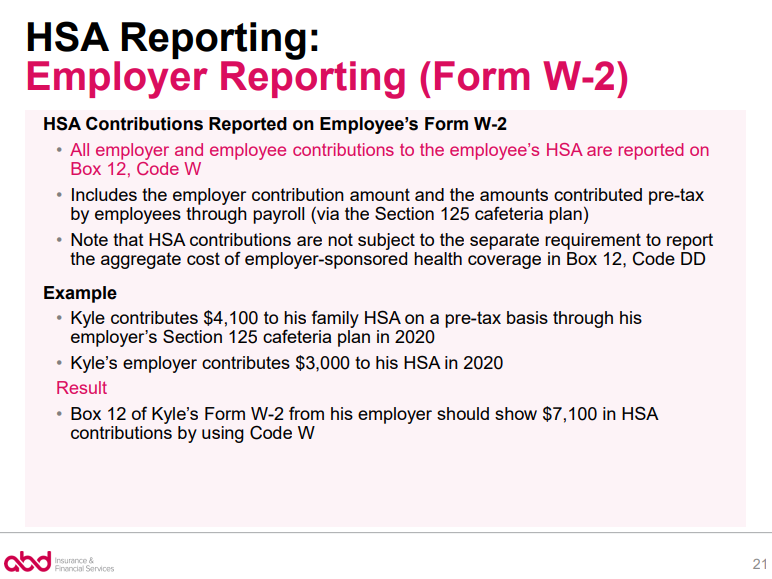

CODE W Box 12 Code W reports the amount of HSA contributions paid by your employer PLUS the amount of pre-tax HSA contributions paid by the employee. And ii a profit-sharing contribution to the solo 401k equal to 20 of that same number ie. An employers match doesnt count toward that contribution limit but the employer match does have its own separate limit and theres a cap on the total contribution amount from the employee and employer combined.

The 18k contribution can be classified as an owners draw -- you are taking that portion out of the earnings to set aside for retirement this is referred to as the deferral or employee portion. 35000 x 006 2100. 12000 - is employee contribution profit sharing and.

Employers who wait until the 15th day of the following month to deposit deferrals might find out that they owe a penalty among other consequences. Note After-tax HSA employee contributions are not reported on your W-2. If we stick to the original example above your employer match will max.

June 7 2019 257 PM. I up to 24000 as an employee contribution less any amount contributed as an employee contribution to her 401k plan sponsored by her daytime employer. Of that number she could contribute for 2017.

Heres an example of how pre-tax deductions work for a single person with a 45000 salary contributing 10 of their gross salary. He earns W-2 income of 70000 and 90000 respectively. If the plan didnt permit catch-up contributions the most Joe could defer would be 19500.

Generally contributions to your 401 k or TSP plan will show up in box 12 of your W-2 form with the letter code D. It is understandable that some employers might think this is the deadline for depositing 401k contributions. Click under Item Name to bring up drop-down list.

Solo 401k and its effect on w2 1120S and 941. In each case the employee earns 1000 a week or 52000 a year and is single. Your contributions could be capped at 6 of your salary for example.

The income tax on 32900 is 525 less than the tax on your full salary. Check the box for Employee is covered by a qualified pension plan if employee participates in a 401k 403b 408k6 SEP or SIMPLE IRA plan. Line 14 from her K-1 -12 of the self-employment tax provided that her overall contribution to the solo 401k.

401 k Plan Overview. If Joe Saver whos over 50 has only one employer in 2020 and participates in that employers 401k plan the plan would have to permit catch-up contributions before he could defer the maximum of 26000 for 2020 the 19500 regular limit for 2020 plus the 6500 catch-up limit for 2020. For example an employer might agree to match contributions up to 5 of an employees salary.

Box 1 of your W-2 will only show 45000 of taxable income not 49000 which means essentially that your 4000 has already been deducted before the income even hits your tax return. Net pay if paid twice per month without a 401 k contribution. A 401 k and a SIMPLE IRA Robert is 40 years old and covered by both a SIMPLE IRA plan and a regular 401 k plan.

In that case if an employee earning 1000 per week contributed 5 of her salary and her employer matched that amount shed see her 401ks principal balance grow by 100 per week even though she was having only 50 deducted from her weekly paycheck. One way your employer could contribute to your 401k is by matching 100 of your contribution up to the cap. When you contribute 6 of your salary into a tax-deferred 401 k 2100your taxable income becomes 32900.

I have a S corp. Let me give you examples of an employee who does not participate in his companys 401k and two who do.

:max_bytes(150000):strip_icc()/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information Definition

401k Vs Roth 401k Vs Roth Ira Scrubs Money Life

Solo 401k Contribution Limits And Types

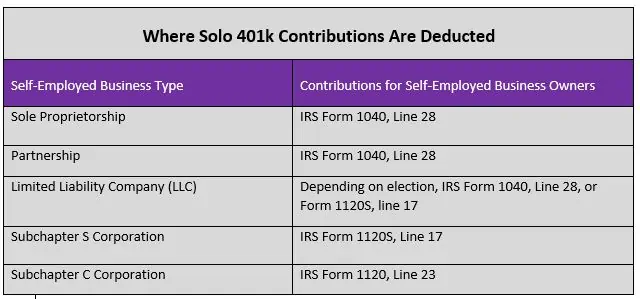

Solo 401k Contribution Limits And Types

What Is A True Up Matching Contribution

401k Contribution Impact On Take Home Pay Tpc 401 K

Math You 5 4 Social Security Payroll Taxes Page 240

Box 12w Hsa Employer Contributions Asap Help Center

Form 1099 R Instructions Information Community Tax

Solo 401k Contribution Limits And Types

Irs Form 1099 R Box 7 Distribution Codes Ascensus

Hsa Form W 2 Reporting Newfront Insurance And Financial Services

After Tax 401 K Contributions Retirement Benefits Fidelity

Key Issues Tax Expenditures Types Of Taxes Tax Infographic

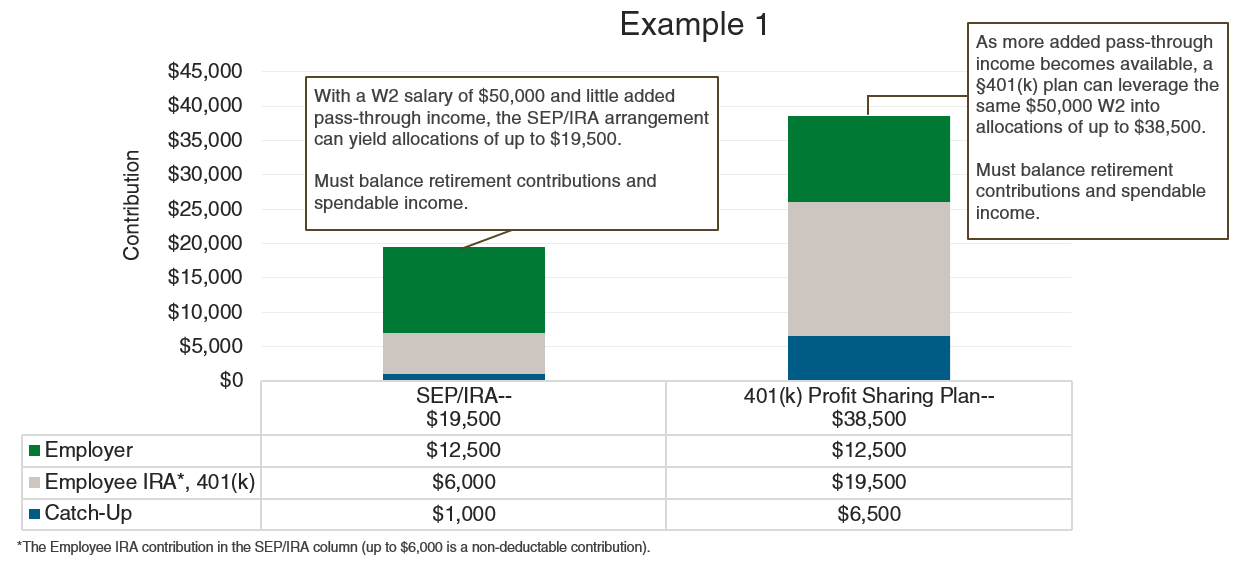

Qualified Plans For Owner Only S Corporations Library Insights Manning Napier

Hsa Form W 2 Reporting Newfront Insurance And Financial Services

Understanding Tax Season Form W 2 Remote Financial Planner

The 401 K Mistake Executives Earning Over 290 000 Make All The Time

Post a Comment for "Example W2 With 401k Contributions"